CV accountant

Creating a strong accountant CV is essential for standing out in today’s competitive job market. The role of an accountant goes beyond just numbers — it involves financial analysis, budget planning, tax compliance, and strategic decision-making. Whether you are a junior accountant or a senior financial expert, your CV must highlight your technical skills, attention to detail, and understanding of accounting standards. A well-crafted accountant CV should clearly showcase your experience, certifications, and software proficiency. In this guide, learn how to present your accounting skills effectively to attract potential employers and advance your career.

Detail-oriented and reliable accountant with over 5 years of experience in financial reporting, budget management, and tax preparation. Strong knowledge of accounting standards (IFRS, GAAP) and advanced skills in Excel and QuickBooks. Proven ability to support decision-making through clear financial analysis and accurate reporting.

Professional Experience

Accountant

BrightStone Financial Ltd., London

[Date]

- Prepared monthly and annual financial statements in accordance with IFRS.

- Managed accounts payable and receivable processes.

- Collaborated with external auditors during year-end audits.

- Implemented cost-saving strategies that reduced overhead by 10%.

Junior Accountant

Green & Co. Chartered Accountants, Manchester

[Date]

- Assisted in preparing tax returns for individuals and SMEs.

- Reconciled bank statements and maintained general ledgers.

- Supported senior accountants with budgeting and forecasting tasks.

- Gained hands-on experience with accounting software (Sage, QuickBooks).

Education

Bachelor’s Degree in Accounting and Finance

University of Manchester, UK

[Year of Graduation]

Diploma in Financial Accounting

London School of Business and Finance

[Year of Certification]

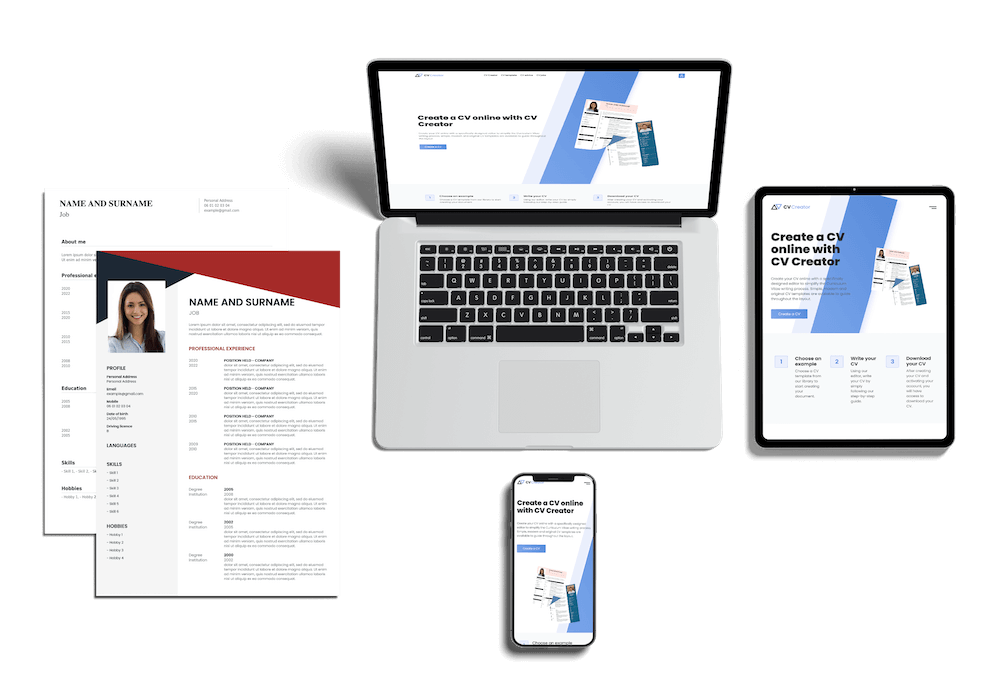

Want to see more CV templates?

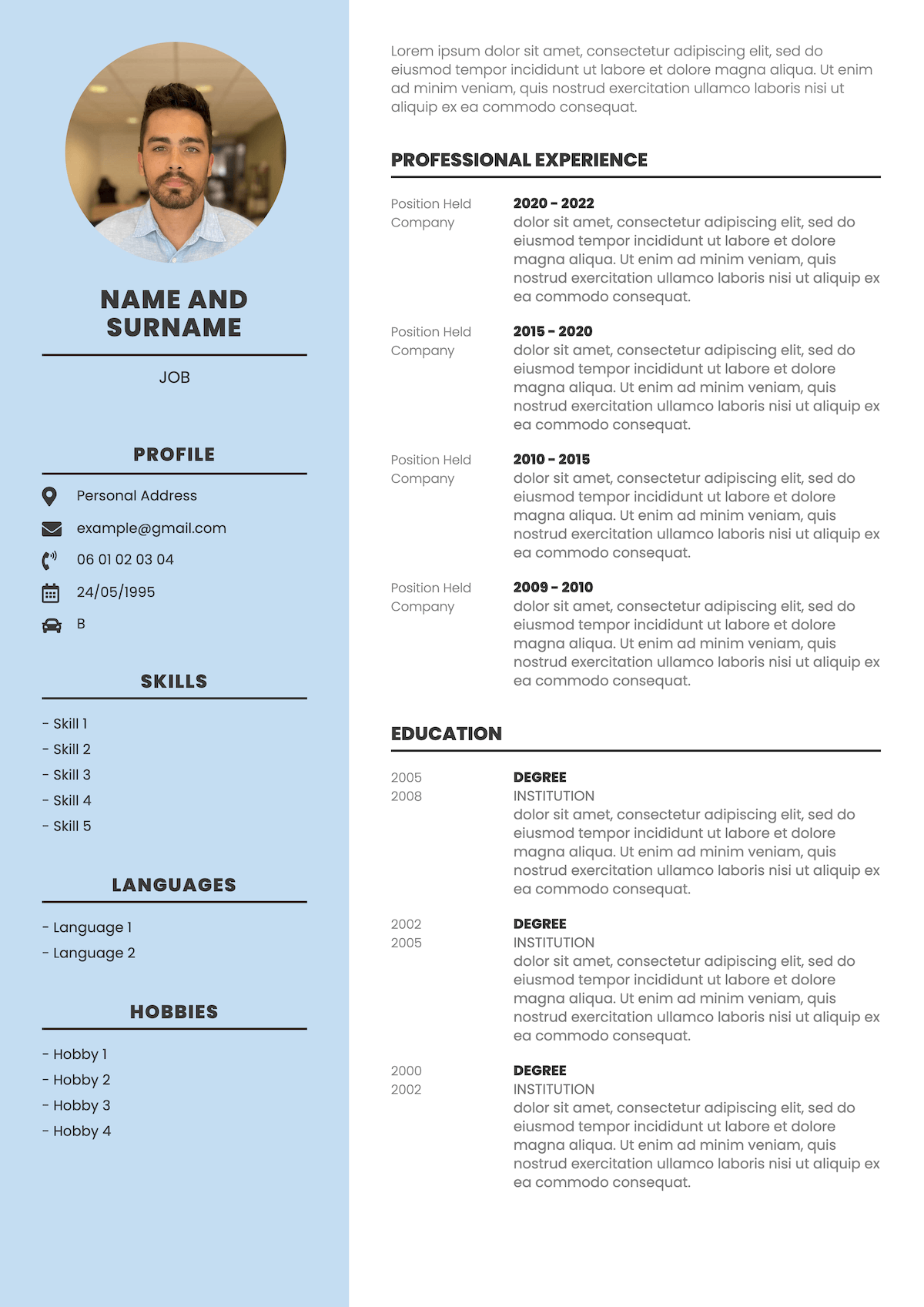

The different parts of the accountant CV

A well-structured accountant CV is essential for anyone seeking a career in finance, bookkeeping, or auditing. Employers in this field look for precision, reliability, and a solid grasp of financial procedures. To stand out, your CV must present your profile clearly and professionally, highlighting your technical skills, work ethic, and attention to detail. The structure and content of each section are crucial in conveying your suitability for the role. Let’s explore the different parts of an accountant CV, with examples to help you craft each one effectively.

The about section

The about section (also known as the professional profile or summary) is the first thing recruiters will read. It should provide a quick overview of your background, strengths, and career goals. This section typically includes years of experience, key skills, and a short description of your professional personality. It should be concise, impactful, and tailored to the accounting role you are applying for. It plays a crucial role in the overall structure of the CV, helping to set the tone for the rest of your application.

Example:

“Detail-oriented and highly organized accountant with over 6 years of experience in financial reporting, tax preparation, and budget management. Proven ability to work under pressure and meet tight deadlines. Skilled in using QuickBooks, Sage, and Microsoft Excel to streamline financial operations and support strategic decision-making. Seeking a challenging role in a dynamic company to contribute with precision and integrity.”

The tone should remain formal and confident, and the content should be updated depending on the position or company.

The skills section

The skills section of your accountant CV is one of the most important parts. Recruiters often scan this part quickly to see if you possess the necessary technical competencies. It is best to list between 6 to 10 key skills, mixing hard skills (such as accounting software proficiency) with a few soft skills (such as time management or communication).

Example:

- Financial reporting and analysis

- General ledger maintenance

- Tax compliance and audit preparation

- Budgeting and forecasting

- Proficiency in Excel, QuickBooks, and SAP

- Attention to detail and accuracy

- Problem-solving and critical thinking

- Strong communication skills

Tailor your list to match the job description, using similar keywords that appear in the job offer. This increases your chances of passing Applicant Tracking Systems (ATS).

The languages section

In today’s global job market, language skills are a strong asset, especially for accounting roles in international companies or multinational audit firms. In this section, clearly indicate your level of fluency for each language. You can use terms like native, fluent, intermediate, or basic. If you have official certifications (e.g., TOEFL, DELF), you can include them too.

Example:

- English: Native

- French: Fluent (B2 level)

- Spanish: Intermediate

Certification: TOEIC 910/990 (2023)

Being multilingual in the finance industry shows adaptability and the ability to work with international clients or foreign regulations, which can be a valuable advantage.

The interests section

Though optional, the interests section can give employers a glimpse into your personality. It should reflect who you are outside of work, while remaining relevant and professional. Avoid overly vague interests like “music” or “movies,” and instead focus on activities that demonstrate qualities like discipline, leadership, teamwork, or curiosity.

Example:

- Long-distance running (participated in 3 half-marathons)

- Reading finance-related books and publications

- Volunteering in tax clinics for low-income households

- Travel and cultural exchange programs

- Learning Excel VBA and financial modeling tools

This section is also a great way to connect on a human level, especially in small or medium-sized companies where cultural fit is as important as technical skills.

The professional experience section

The professional experience section is the core of your accountant CV. It should be presented in reverse chronological order, starting with the most recent role. For each position, include the job title, company name, location, dates, and key responsibilities. Use action verbs (e.g., “managed,” “prepared,” “optimized”) and focus on achievements where possible. Quantify results to show the impact of your work.

Example:

Accountant – ClearView Finance Ltd., London, UK

March 2021 – Present

- Prepared monthly and annual financial statements in compliance with IFRS.

- Managed accounts payable and receivable, reducing late payments by 20%.

- Oversaw internal audits and coordinated with external auditors during fiscal year-end.

- Assisted in creating annual budget reports and forecasting cash flows.

- Trained junior accountants on proper data entry and reconciliation techniques.

Customize your job responsibilities to reflect the financial functions relevant to the job you are targeting. Keep bullet points clear and avoid long paragraphs.

The education section

The education section on an accountant CV plays a crucial role in showing your academic background and certification. For most accounting roles, at least a bachelor’s degree in accounting, finance, or economics is expected. If you’ve taken additional courses or obtained certifications like ACCA, CPA, or CIMA, make sure to include them here.

List your qualifications in reverse chronological order, indicating the degree, institution, location, and years of study. You may also add honors or relevant coursework if space allows.

Example:

Bachelor of Science in Accounting and Finance

University of Leeds, UK

2015 – 2018

- Graduated with Honors

- Relevant coursework: Financial Accounting, Corporate Finance, Taxation, Business Law

Including your progress in certifications (even if not completed) shows employers your motivation to grow in the field.

How do I list in-progress qualifications on my CV?

When you have qualifications in progress, it’s important to show them clearly on your CV to demonstrate your commitment to professional development. You can include them under the Education or Certifications section, indicating that the qualification is “in progress” or “currently studying.” Make sure to specify the name of the qualification, the institution, and the expected completion date. This shows employers that you are actively investing in your career and improving your skills. For example: “ACCA – In Progress, expected completion: 2025.” Always be honest and avoid exaggerating your current level.

How do I present a career gap on an accountant CV?

To present a career gap on your accountant CV, honesty and clarity are key. Use your CV to indicate the gap in your timeline, and briefly explain it in your cover letter or interview, focusing on what you learned or achieved during that time. If you took courses, volunteered, freelanced, or managed finances for a small business, include those as relevant experience. Label the time appropriately (e.g., “Career Break – January 2022 to June 2023”) and highlight any skills maintained or acquired. Gaps are not a weakness if you show growth, resilience, and readiness to return.

Should I include internships in my accountant CV?

Yes, internships are very valuable and should absolutely be included in your accountant CV, especially if you are an entry-level candidate. Internships show that you have practical experience in a real work environment and have applied accounting principles outside of the classroom. List them in the Professional Experience section, just like a regular job, with responsibilities and any achievements. Even short-term internships can demonstrate your work ethic, your ability to learn, and your exposure to accounting tasks such as reconciliations, reporting, or software usage. They also reflect your initiative and motivation to grow in the field.

What is the ideal length of an accountant CV?

The ideal length of an accountant CV is typically one to two pages, depending on your level of experience. For junior or entry-level accountants, one page is often enough to present your education, internships, and skills. For professionals with several years of experience, two pages allow you to detail roles, achievements, and qualifications without overcrowding the layout. Avoid exceeding two pages unless specifically requested. Keep content clear, well-structured, and tailored to the job. Use bullet points, concise phrases, and clear headings to help recruiters scan your CV quickly and find the most relevant information.

Create your CV now

Choose a template CV and create your own online